Your burning questions, (expertly) answered.

Welcome to your real estate safe space. A library of everything you've ever wanted to know about real estate, answered honestly and jargon-free by our friendly team of real estate industry experts.

The people have spoken.

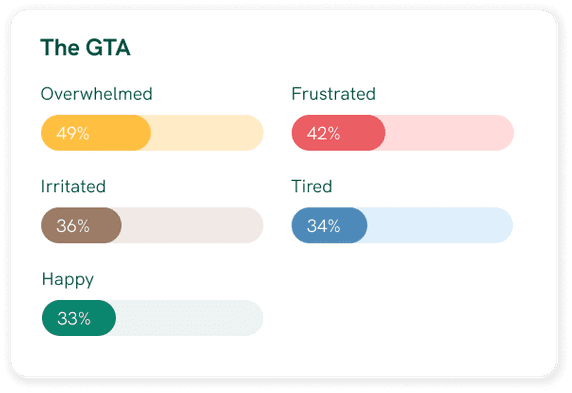

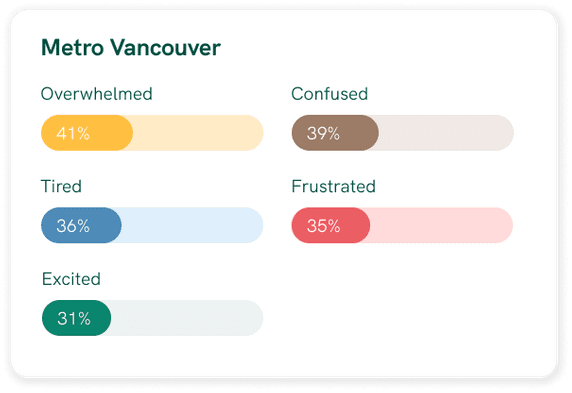

Over 40% of buyers and sellers in Ontario and BC feel overwhelmed by the real estate process. Here's what they want to know.

What are some types of fraud I should be aware of as a homebuyer?

Title fraud, when someone steals the title of your home, and foreclosure fraud, when you unknowingly transfer your title in order to secure a loan that would help with mortgage payments, are two of the more common types of fraud in real estate. There are preventative steps you can take including speaking with a lawyer before allowing any third party to have control over your home or title, and getting title insurance to protect against title fraud. More information on what to do if you think theres fraudulent behaviour at play can be found on the government's website.

What do you need to do qualify for a mortgage as a self-employed person?

It's a similar process whether you're self employed or work for someone else, however you may need to provide a longer employment history and income statements to show stability in your work (and reassure the lender you have a steady income to pay them back with). You'll likely need to start with your Notice of Assessment for the last two years, sole-proprietorship or incorporation statement and bank statements, but make sure you connect with a mortgage professional who can give you the full checklist of things you'll need to apply.

What should I do if I’ve fallen victim to mortgage fraud?

If the mortgage broker you're working with has misrepresented anything related to your financial situation, it's important to seek legal advice and report it. You may already be working with a real estate lawyer as part of the team of people involved in buying and selling a home, so they can guide you to the appropriate authorities to report this activity to. As mortgage brokers are governed by the Financial Services Regulatory Authority, you can also follow the steps here to file a complaint.

Should I keep my current home as an investment property but buy a new home?

Like so many big life choices, this one depends on your unique circumstances. To manage any risks, start by consulting with the right financial and real estate advisors. In this fast-moving market, you want to think long-term, to make sure your investment today aligns with your goals tomorrow. This is an exciting and deeply personal choice, so after doing your due diligence, it's up to you to decide if it's the right one for you.

Is it normal to feel scared?

In short: YES. 69% of buyers and sellers are stressed out by the real estate process, so you're not alone. Even if it gets you closer to that career-transforming job, makes room for your growing family, or secures your financial freedom, moving takes you from a familiar space to one where you’re not 100% sure what will happen next. Unfortunately, the current real estate experience is unnecessarily complicated and intimidating, which doesn't help. But we've got your back with a team of experts committed to doing things differently to make your move stress-free, and a little less scary.

I'm definitely curious to know what it takes to qualify to buy a home with your own business ... especially when it comes to income.

When applying for a mortgage as a self-employed person you may need to provide more proof of income than someone who works for someone else. This is because lenders tend to look at the steadiness of income, and when you own your own business, it's more likely that your income may fluctuate. Providing more data gives lenders a better picture of your financial health!

Be ready to share your Notice of Assessment for the last two years, sole-proprietorship or incorporation statement and bank statements, but make sure you connect with a mortgage professional who understands your unique situation and can provide tailored advice.

What are some signals I am ready to purchase my second property?

Your financial situation is, unsurprisingly, one of the most important factors here. Consider whether you can support a second mortgage, and if you have funds available for the down payment (if you plan on living in this second home even for part of the year, like with a cottage, the down payment requirements are similar to your primary residence).

Look at your income level, existing debts (i.e. your current mortgage), credit score, debts you may collect for this new property, and closing expenses like home inspections. Whether you're interested in a second primary residence or an investment property, consult a trusted financial advisor to make sure a second home is sustainable for you in the long-term!

What does today's interest rate decision mean for me as a potential homebuyer?

While the ongoing rate hikes and market slowdown don't sound great, they've created an environment that's pretty beneficial for buyers. Things that weren't possible in the earlier, uber-competitive sellers' market are now a reality: like making conditional offers, and even offering under asking. With that said, rising interest rates have an impact on your monthly mortgage payments, so you'll want to do your homework on the right mortgage that'll support your long-term goals through this volatile market and beyond.

Why isn’t bidding more transparent?

Provincial real estate regulators and local boards set the rules for bidding in their jurisdictions. In the Greater Vancouver Area, sellers have the right to choose whether or not bids will be disclosed, and in the Greater Toronto Area disclosing offer details is banned.

Submitting a bid without knowing what the other offer amounts are can be really frustrating as it can lead to paying more for a property than you need to (to beat out other competing offers). While some changes are being proposed to improve the process in Ontario (like giving sellers the option to have an 'open' bidding process), until then you can rely on the data provided by your agent and online pricing tools to give you an accurate home value, and ensure your offer is strong and fair.

How do I find a real estate agent that doesn’t take advantage of me?

You can set yourself up for success by treating your search for a real estate agent like an interview — here are some questions you can ask. Try to get as much information about their knowledge of the industry, their expertise and proven feedback/results from past clients. You want to make sure that your agent works with a reputable brokerage, understands your needs and has a communication style that works for you.

What happens if the person who is buying my house backs out and the house I am going to be buying is on condition of the sale?

It's impossible to make a prediction without knowing the exact terms of each transaction, though it's likely that both the sale of your current home and the purchase of your new one would be cancelled. If you find yourself in this situation, it's crucial that you speak with your real estate lawyer for advice.

How do I determine the monthly costs of owning a home?

Look beyond your up-front expenses (not sure about those either?Here's what you need to know) and consider things like your mortgage payments and protection insurance, property taxes, utilities, home insurance, general maintenance and, if applicable, condo fees. Sometimes your agent can ask the seller for an estimate of what their monthly expenses look like to help you calculate your budget.

Is this a good time to invest in real estate? I'm looking to invest for long term return, but I don't know if the market is too expensive now. Does it make sense to purchase for rent a townhouse, a condo, land?

On average, home prices have dipped so now may actually be a great time for buyers to make their move if they're financially ready, as you finally have more negotiating power. Keep in mind, though, that the interest rate on your mortgage will be higher than in the past few years, so be sure you account for that in your budget. While the market is in a cooling phase right now, the basic housing supply issues that Toronto and Vancouver have always faced haven’t gone anywhere. That means the housing market is poised to return back to more competition for homes and rising home prices once the Bank of Canada ends the cycle of interest rate hikes.

Bottom line: Physical assets like homes remain a good long-term investment.

When do you think the real estate market will bottom out?

By 2023, the Bank of Canada is expecting our GDP growth to slow, which should reduce inflation and may lead to a pause on rate hikes later in 2023 — conditions that may see more people buying homes again. Today's housing shortages are likely to increase by then too, since builders (due to inflation increasing the cost of their materials) have halted residential developments in Toronto and Vancouver. This uptick in competition in a market with limited stock is likely to see prices go back up.

How do you use your RRSP to buy a home?

You can use up to $35,000 from your RRSP to fund the down payment on a home by opting into the government's Home Buyers' Plan, but only if you're a first time home buyer. Let your mortgage agent or the bank your RRSP is sitting with know that you'd like to opt into the plan, and they'll provide you with the forms you need to get started!

What does the recent interest rate decision mean for me as a potential home seller?

Rising interest rates are further restricting buyers' purchasing power, which in general is putting downward pressure on selling prices for homes in many parts of the country. So, as a seller, it's important to be realistic about what your home may sell for and how long it may take to sell, so you can make informed decisions about your next move. As every home is unique, it's important to speak with an expert who can make personalized recommendations for you.

What does today's interest rate decision mean for me?

Whether you're a buyer, seller, or homeowner, the rate increase could impact you in a few different ways (read here for a deep dive). Where rate hikes are causing more caution among sellers, buyers — who continue to hold power in this market — are gaining an edge in negotiations. When it comes to financing, it’s more important than ever to do your homework to make sure you can afford your monthly mortgage payments.

Should I be buying right now?

Buyers have a lot of power right now! As a buyer you're able to take more time, make conditional offers, and even offer under asking - which is a big departure from earlier this year. But, there are many factors that should go into your decision whether to buy including your financial stability, whether it makes sense for your lifestyle and if it fits with your long-term goals. Our advice? Talk to an expert who can give you personalized advice.

How much are lawyer’s fees?

Fees for a real estate lawyer can vary depending on the complexity of the purchase or sale. However, many lawyers charge a flat fee for straightforward transactions. Expect to spend a minimum of $1,000 for legal fees and disbursements for a purchase or sale.

Will rates keep going up?

While we don't have a crystal ball (we wish), many are predicting there's another rate hike coming in December in an effort to further curb inflation. Stay informed on how the latest rate hikes areimpacting buyers and sellers while we prepare ourselves for what will (or won't) happen at the next scheduled announcement in December.

How do I get a line of credit?

You can apply for a line of credit with a bank or a credit union. A home equity line of credit (HELOC) also comes from the bank, but they'll use your home as it's guarantee that you'll pay them back. Similar to a mortgage, you'll need to qualify for a HELOC. There's lots to consider when deciding if a line of credit is the right choice for you, so we always recommend you speak with a professional first!

When do I get approved for a mortgage? Do I talk to a bank or a real estate agent first?

Technically, your mortgage only gets approved after your offer to buy a home has been accepted. But it's a good idea to get a mortgage pre-approval first — which you can do any time during your home search by talking to your existing lender (if you have one!) or a mortgage broker.

Why? A mortgage pre-approval helps you figure out exactly what you can afford. Click here to learn more about the pre-approval process.

What is escrow?

Escrow is typically an American real estate term for when a third party (like a lawyer) temporarily holds your money until your purchase agreement is fulfilled. In Canada, things work a little differently. If a home has “sold conditionally”, both sides have accepted the offer but there are certain conditions (like financing or home inspections) that usually need to be fulfilled by the buyer(s). Depending on where you live, either the buyer’s or seller’s brokerage will hold your deposit until you close. Real estate can be full of jargon, sohere's a handy guide on other terms you may be curious about.

Can I still obtain a mortgage and buy a place when I'm on a limited income, i.e., as a retired person?

Yes! It's definitely possible for you if you meet the criteria of the lender. Your mortgage approval depends on a few different factors including your credit rating, income (if you're working), and amount you have available for your down payment. And, if you're retired, lenders have programs designed to account for Old Age Security and Canada Pension Plan income. Mortgage brokers and lenders will take your personal situation into account - including how much equity you have in your current home if you're a homeowner - when you start the application process.

Will my condo be worth less soon?

As we've seen home prices dip this year, it's normal to wonder whether your home will follow the same trend when you decide to sell! While we don't have a crystal ball, there are signs pointing to the market recovering as soon as next year. Some of these indicators are constrained supply and high immigration numbers. This increase in demand for housing coupled with a relatively small pool of homes available has historically led to rising home values. But, it's a good idea to keep tabs on the value of your home as there are a lot of different factors that contribute to it.

What can I do to get a better price for my home?

Good news - there are many ways to maximize the sale price of your home. Start by working with an agent who understands the market. They'll understand the buyer behaviour unique to your neighbourhood and can craft a listing strategy aimed to maximize your selling price. Properly (pun intended) marketing your home is also so important, as is showcasing it in its best light through a professional deep clean, high quality photography and perhaps most importantly, the power of staging.

What's the best way to save money for a downpayment? Any popular cash like securities? I don't want to use a GIC or a savings account

There are a few different routes you can take to save up for a down payment. However, outside of savings accounts and GICs, there are no other cash-like equivalents that come with no risk. Other options like stocks and mutual funds are exposed to market risk that could have a direct impact on how much you&apo';ve accumulated.

In addition to saving for a down payment, you may be able to take advantage of government programs to help with and/or subsidize a down payment. Read more about them here.

How does the interest rate hike affect me?

Let's start with your mortgage payments. If you're an adjustable rate mortgage holder, this hike means you'll be paying more each month. If you have a Static Payment Variable rate, your monthly payment will cover more interest (vs the principal amount). If you're on a fixed rate and coming up for a renewal, you're likely to face higher monthly payments once you have your renewed mortgage.

Prospective homebuyers: learn the difference so you can make the right choice in this volatile market. It's not all bad news — we're still in a buyer's market, where sellers are accepting more conditional offers. Sellers, that means you'll want to prepare for negotiations, and prep your home to stand out from the competition. Dig into all the implications of this hike with our experts.

How do I know how much money I need for a downpayment?

Your down payment amount is based on your future home's final purchase price (you can start with an estimate). For homes that cost $500,000 or less, the minimum down payment is 5%; for homes that cost between $500,000 and $999,000, it's 5% for the first $500,000, then 10% for the rest; and for homes that cost $1 million or more it's 20%.

When will these rising rates stop?

First, let's dig into why they're going up in the first place: it's all part of the Bank of Canada's (BoC) goal to keep our inflation in check, and balance out the market (as the go-to tool to quickly cool an overheated economy). The BoC expects GDP growth to slow in 2023, which should slow down inflation, which, in turn, might lead to a pause on rate hikes in the latter part of 2023.

What is a “lien” on a home?

A lien is a claim against an asset (like a home) that is typically used as collateral to satisfy a debt. While all liens are tools designed to help people or corporations recover money owning to them, every situation is different. Your agent should be able to tell you if there are any liens on a home you're interested in. If there are, we suggest talking with a lawyer. There's a lot to consider when buying a home, so here's a list of other important factors to keep in mind.

Do you think prices will go back up?

The Bank of Canada (BoC) just increased its interest rates again, which means less people are buying homes (even though more are looking to sell). More supply and less demand means prices aren't likely to increase anytime soon — though that isn't necessarily a bad thing for sellers. With that said, there's a few factors that, long term, will very likely lead to home prices increasing again due to low supply and high demand. These include: The Bank of Canada eventually stabilizing or even decreasing its interests rates, Canada already increasing its lofty immigration targets (who will largely settle in Vancouver + Toronto), and construction projects slowing due to the rising costs of materials and labor.

How much is land transfer tax and why is it so expensive?

The province and/or city charge this tax, so your land transfer tax varies depending on your region and the purchase price of your new home. Here's a helpful calculator from Toronto and British Columbia to help you get an idea of how much it could be for your situation. But, you'll always want this independently calculated and verified by your lawyer prior to closing.

How much is a house in Rosedale?

Rosedale is one of the oldest - and most expensive - neighbourhoods in Toronto. According to the latest data from the Toronto Regional Real Estate Board, the median home price for a detached home in Rosedale is $5M, and $2.65M for a semi-detached home. Have hopes of settling down here? Here are some homes for sale.

How does strata work in BC?

In strata housing, the owners own their individual strata lots and together own the common property and common assets as a strata corporation. It is similar to condo ownership in other parts of the country.

Think of apartment units as strata lots and areas such as the lobby and parking as common property.

What is a mortgage broker?

A mortgage broker is someone who connects you (the person looking for a mortgage) with the institution who can give you the loan (like a bank, for example). There are lots of variables when it comes to the mortgage you choose such as interest rate, mortgage type, and the time you have to pay it back, so a good broker will take the time to find the best fit for you, since they have access to hundreds of products from different lenders. If you have more questions, our mortgage team can help.

What's the minimum down payment for a house?

First, you need to know your future home's final purchase price (but to start, an estimate will do!). For homes that cost $500,000 or less, the minimum down payment is 5%; for homes that cost between $500,000 and $999,000, it's 5% for the first $500,000, then 10% for the rest; and for homes that cost $1 million or more it's 20%.

How much is a deposit?

While there's no standard minimum, deposits are usually 5% of the purchase price. So, if you're buying a house for $800,000, you might make a $40,000 deposit — and, remember, this will be applied to the purchase of your new home (vs. an extra fee). Understand how this works here.

Are fixed or variable rate mortgages better?

The short answer is: it depends! Fixed rates are great if you want to know exactly what you'll pay each month while variable rates allow you to take advantage of any interest rate drops and are generally easier to qualify for (we say generally because when interest rates rise, which they have been lately, it becomes harder to pass the mortgage stress test).

Our advice? Talk to a mortgage broker to find out what's best for you. You can also learn more on fixed vs. variable rates here.

What is the downpayment on a 2.5 million dollar home?

The minimum down payment for a $2.5M home is $500,000 (any home over $1M requires a minimum down payment of 20% of the purchase price). The deposit you gave with your offer also goes towards this down payment amount. So, for example, if you provided a $125,000 deposit, you would owe an additional $375,000 on the purchase closing date to make up your full down payment amount. You can read more about how down payments work here.

What is a bully offer?

A bully offer is when a buyer submits an offer before the official offer date. It might sound aggressive, but it can lead to good outcomes — like a shorter time on market for the seller and avoiding a bidding war for the buyer. Another tactic that never hurts? Writing a personal letter to the seller.

How are mortgage rates calculated?

Mortgage lenders base their rates on the benchmark interest rates set by the Bank of Canada. So, if the benchmark rate rises, so do the lenders' rates, meaning you're paying more interest on your monthly mortgage payments. Here is where you can read more about the impact of interest rates on mortgages, or check out this mortgage FAQ for other popular financing questions!

What is the Bank of Canada?

TL;DR — They're Canada's central bank, and they set our benchmark interest rate. The Bank's mandate is to promote economic stability in Canada. They do a lot, but buyers and sellers often feel the Bank's influence the most when they change interest rates, which impacts how much interest you owe the bank on your mortgage payments. Read more about what rate changes mean here.

How much are closing costs?

Closing costs are typically between 2-4% of your home’s purchase price. For a $1M home, that's anywhere from $20K to $40K. This can vary by province, and includes things like land transfer tax, condo/strata fees, and insurance. Get clear on how much you need to save here.

When do you get an inspection?

You can get an inspection before making an offer, or make your offer conditional on getting an inspection done. No matter when you do it, home inspections are so important to making sure there are no unpleasant surprises when you move into your new place. If the seller hasn't done one, and you’re serious about your offer, it's definitely worth the investment.

We asked 1,600 Ontario and BC residents how they feel about the real estate process. Here’s what they had to say:

Real estate is an emotional rollercoaster

These are the most common feelings buyers and sellers experience:

Most people are stressed about moving

of GTA residents feel stressed out by the process. Here’s why:

of Vancouverites feel stressed out by the process. Here’s why:

But there's a lot to be excited about

Moving into my new home

GTA: 52%

Metro Vancouver: 52%

Being done with the process

GTA: 40%

Metro Vancouver: 38%

Owning a real estate asset

GTA: 36%

Metro Vancouver: 32%

And there’s appetite to know more: 92% of GTA residents and 89% of Vancouver residents said they want to learn more about elements of the real estate process

Specifically, people want to understand:

How to get an estimated sale price for their home

How to access market data to inform their decisions

How to guarantee the sale of their current home

The survey was conducted in partnership with Maru/Blue. Survey data is based on responses from 1,611 Canadian respondents in Ontario and British Columbia aged 1 8+ between August 25-27, 2022.

Everything you need

Power your homebuying journey with insights from our housing market experts.

5 costs to know about before buying a home (a checklist)

5 costs to know about before buying a home (a checklist) The Scott Brothers explain: Questions to ask your agent

The Scott Brothers explain: Questions to ask your agent 10 key people you'll need to consult when buying a home

10 key people you'll need to consult when buying a home